If you run an LLC, you know every dollar counts. Choosing the right business bank account can free up more cash for growth and help you avoid surprise fees. In this guide, we’ll go over six of the best online banks for LLCs in 2025 that offer no monthly maintenance fees and provide tools designed to help your business grow.

Here are the banks we’ll cover:

- FutureMoney

- Grasshopper Bank

- NorthOne

- Piermont Bank

- Relay

- Rho

What to Look for in a Great Online Bank for Your LLC

Before we dive into the list, here are a few key things to look for when choosing a business bank account:

- Zero or very low monthly maintenance fees

- Unlimited or generous free transactions

- Tools for digital bookkeeping and money management

- Easy online setup and mobile banking

- FDIC insurance through a partner bank

- No hidden fees or minimum balance requirements

Now, let’s look at the best options for 2025.

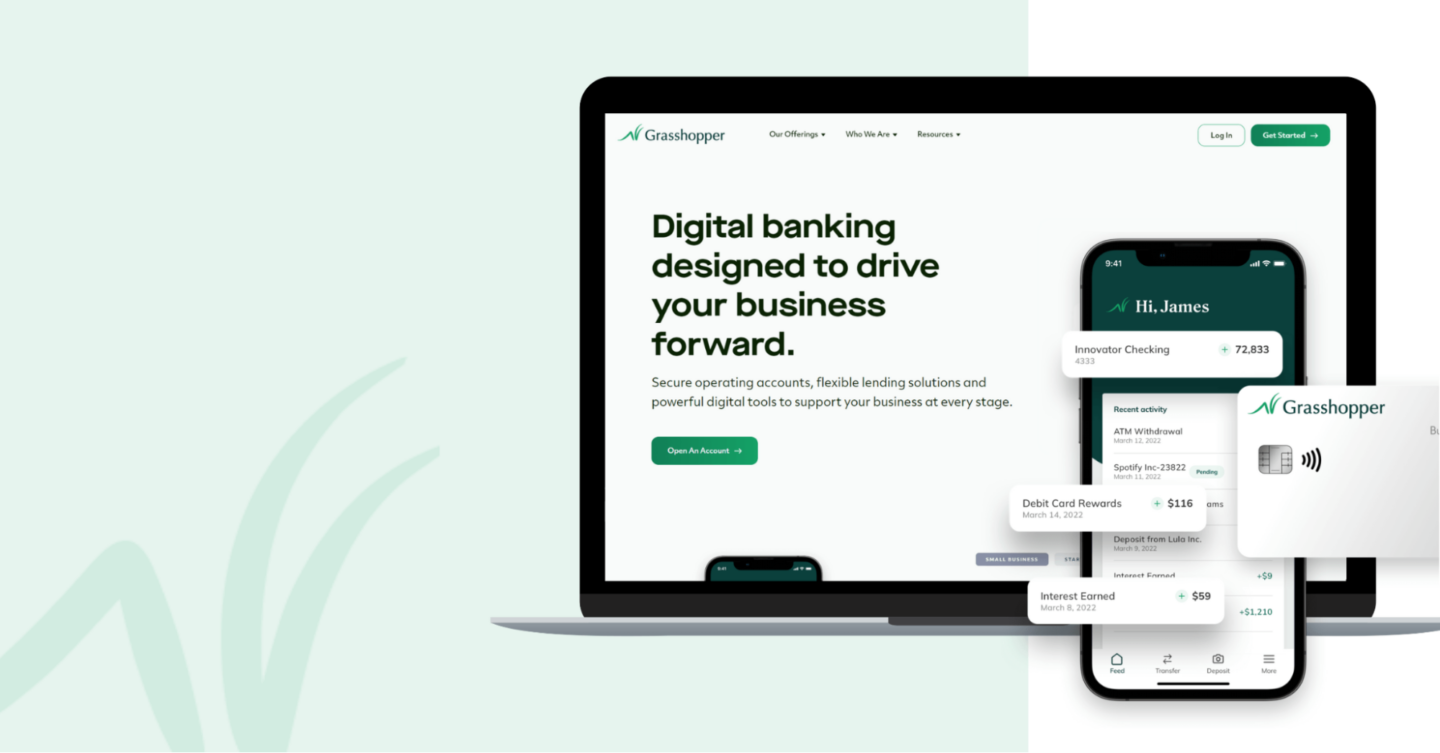

1. Grasshopper Bank

Grasshopper Bank’s Innovator Business Checking account is built specifically for LLCs and small businesses. It offers a smooth digital experience, no monthly fees, and unlimited transactions.

Key features:

- No minimum balance or maintenance fees

- Earn up to 1.55% APY on eligible balances

- 1% cash back on debit card purchases

- Designed for digital-first business owners

Best for: LLCs that want a modern online experience with no monthly fees and the ability to earn interest on balances.

Watch out for: Check whether your business needs frequent cash deposits since Grasshopper is fully online.

Earn up to 3.55% APY and 1% cash back. Plus, unlimited transactions with no monthly fees.

Key Features

No monthly or maintenance fees and unlimited transactions

Earn up to ~1.55% APY on eligible balances

Earn 1% cash back on debit card purchases

Why We Recommend It

Grasshopper Bank is a great fit for digitally‑focused LLCs and small businesses that want both interest earnings and cash‑back rewards without monthly fees. If you can work entirely online and don’t use cash deposits, it’s a solid banking option.

Pros & Cons

- No monthly fees & unlimited transactions

- Interest earnings on checking balances

- 1% cash back on qualifying debit purchases

- Doesn’t support cash deposits

- Fully digital, no physical branches

- May lack some traditional banking services for older‑style businesses

2. NorthOne

NorthOne is designed for freelancers, small business owners, and LLCs who want powerful banking tools without complexity. It’s fast to set up, integrates with popular apps, and offers a clear fee structure.

Key features:

- Earn up to 3.00% APY on balances

- Free unlimited transactions

- No hidden fees

- Integrates with accounting and payment tools like QuickBooks and Shopify

Best for: LLCs that want to earn interest, automate bookkeeping, and streamline finances.

Watch out for: NorthOne is entirely digital, so physical cash deposits may be limited depending on your location.

Key Features

Up to around 3.00% APY on balances (depending on plan and usage)

No hidden fees, no minimum balance requirement

Integrations with business tools and apps like QuickBooks & Shopify

Why We Recommend It

NorthOne provides a streamlined business banking experience for freelancers and small business owners. If you want to earn interest, sync your accounts with your business apps, and avoid surprise fees, this bank fits well.

Pros & Cons

- Transparent fee structure and high‑yield interest potential

- Unlimited transactions and strong integration with business tools

- Mobile‑friendly and entirely digital

- Digital only—limited or no physical cash deposit options

- Some features (like cash‑back or higher APY) may require higher‑tier plans

- Might not suit businesses with heavy in‑person banking needs

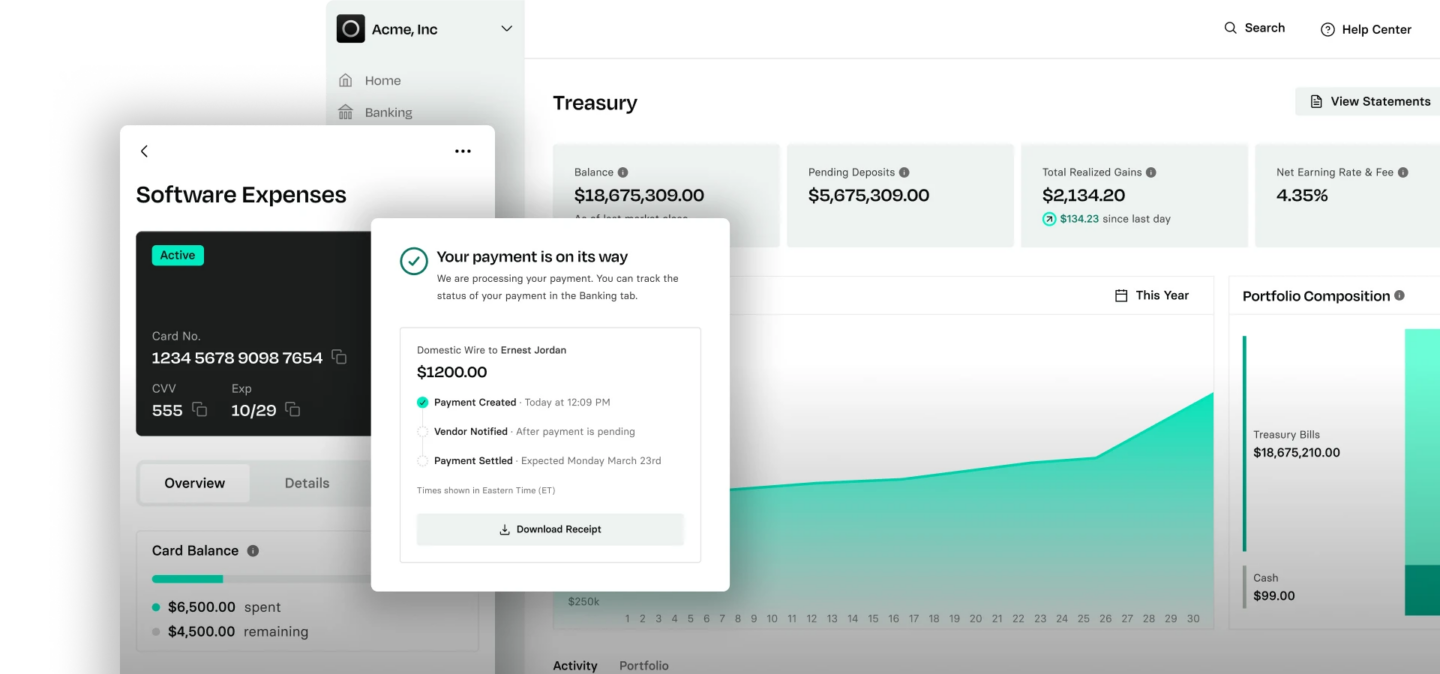

3. RHO

Rho offers business banking and treasury tools for startups and established LLCs. It focuses on automation, efficiency, and financial transparency without charging monthly fees.

Key features:

- $0 monthly fees

- Free ACH and wire transfers

- Real-time expense tracking and controls

- High limits for online payments and deposits

Best for: Tech-focused LLCs, agencies, or e-commerce companies that handle large transaction volumes and want speed, automation, and zero banking fees.

Watch out for: Rho is built for digital operations, so it’s not ideal if you deal with physical cash.

Key Features

Zero monthly fees; free ACH and wire transfers across U.S. business accounts

Built‑in expense, bill‑pay, and spend management tools integrated with cards and accounts

High transaction and cash‑flow limits; strong integrations with accounting software for real‑time oversight

Why We Recommend It

Rho is tailored for growing businesses that want to manage banking, cards, expenses, and payments all in one place without paying hidden fees.

Pros & Cons

- Clean fee structure with no monthly cost

- Deep control over spend and cash flow in one platform

- Excellent for high‑volume digital businesses

- Not designed for businesses relying heavily on physical cash deposits

- Full functionality may require commitment to digital‑first workflows

- May lack traditional branch support or in‑person banking features

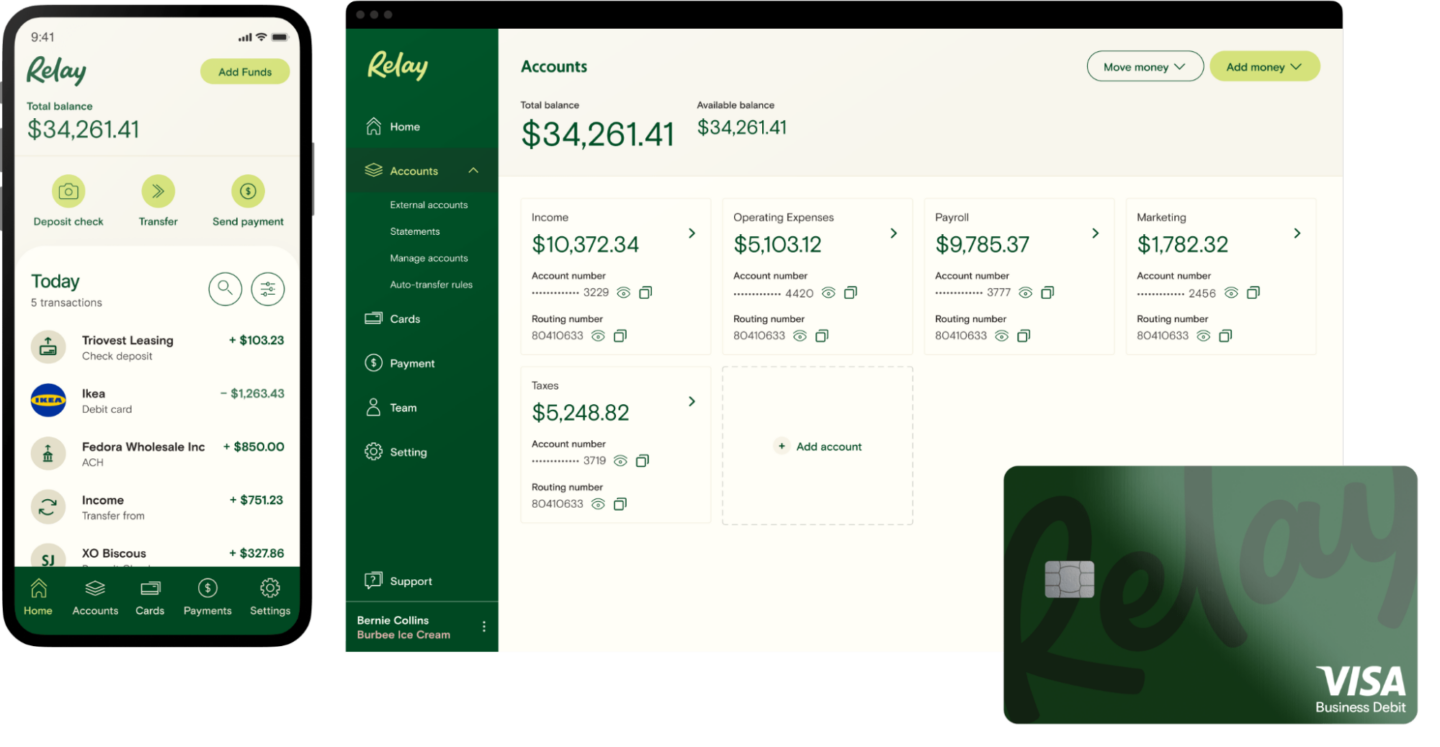

4. Relay

Relay is a small business banking platform built around visibility and control. It allows you to create multiple checking accounts for different purposes and manage them all in one dashboard.

Key features:

- No monthly fees or minimum balance

- Up to 20 checking accounts under one LLC

- Easy integration with bookkeeping tools like QuickBooks and Xero

- FDIC insured through partner banks

Best for: LLCs that want to manage their finances using the “Profit First” system or keep expenses, savings, and taxes organized across multiple accounts.

Watch out for: Relay is best for digital businesses. If you often deposit cash, you’ll need to check its deposit options through its partner network.

Get $100 when you fund a relay account

Key Features

Multiple Checking Accounts: Open up to 20 individual checking accounts to organize finances for operations, payroll, taxes, and more, facilitating better cash flow management.

Integrated Expense Management: Issue up to 50 physical or virtual debit cards with customizable spending limits, and capture receipts directly within the platform to streamline expense tracking.

Accounting Software Integration: Seamlessly sync transactions with popular accounting tools like QuickBooks Online and Xero, simplifying bookkeeping and financial reporting.

Why We Recommend It

Relay offers a fee-free, online banking solution tailored for small businesses, providing tools that enhance financial clarity and control. Its user-friendly interface and robust features make it an excellent choice for entrepreneurs seeking to manage their finances efficiently.

Pros & Cons

- No monthly fees or minimum balance requirements

- Ability to open multiple checking accounts for detailed budgeting

- Direct integration with major accounting software

- No physical branches; entirely online banking

- Does not support cash deposits

- Advanced features like accounts payable automation require a paid plan

5. Piermont Bank

Piermont Bank is a modern digital-first bank built for entrepreneurs, startups, and small businesses. It provides a balance between simplicity and high-level business banking features.

Key features:

- No hidden fees for standard transactions

- Business checking and treasury management tools

- Easy digital setup and support

- FDIC insured

Best for: Business owners who want a professional bank that provides both flexibility and credibility.

Watch out for: Review your account activity and usage since some advanced treasury tools may have fees depending on volume.

Key Features

Business banking built with modern tools and fast digital onboarding

High‑yield money market accounts and business checking with competitive rates for idle funds

Dedicated support from business‑focused bankers and integration with accounting software

Why We Recommend It

Piermont Bank strikes a balance between advanced banking features and the simplicity of digital banking,making it a strong choice for small businesses and startups wanting credibility plus flexibility.

Pros & Cons

- Competitive interest options for savings and business funds

- Combines digital convenience with business‑centric support

- Easy online setup and mobile banking capabilities

- Some advanced treasury or lending features may carry additional fees or volume requirements

- Still primarily digital, less branch presence or legacy services compared to large banks

- Heavy cash‑handling businesses should verify deposit logistics

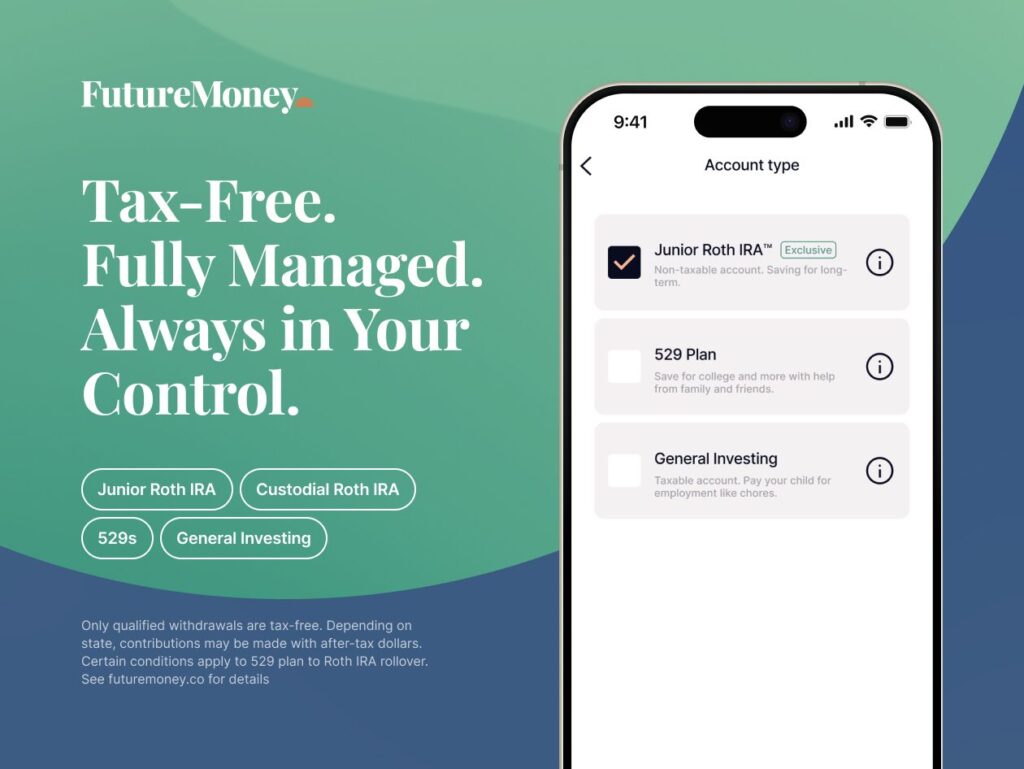

6. FutureMoney

FutureMoney isn’t a traditional business bank. It’s a modern financial platform focused on helping entrepreneurs and LLC owners grow wealth while managing business funds efficiently.

Key features:

- Combines financial management and investing tools

- Easy integration for entrepreneurs who want both banking and investment management

- Transparent fee structure

Best for: LLC owners who want to manage both business finances and investments from one platform.

Watch out for: If you’re looking for a standard checking account, you may prefer one of the other banking-first options on this list.

Key Features

Enables business owners and families to invest alongside managing finances, including setups like Junior Roth IRA, 529 plans, and taxable accounts

Transparent subscription pricing for access and management of investment tools

Aims to integrate business banking and smart investing in one platform for entrepreneurs

Why We Recommend It

FutureMoney is ideal for entrepreneurs who want a banking‑style platform and the ability to invest and grow wealth at the same time, all without juggling separate tools.

Pros & Cons

- Combines investing and financial management in one place

- Clear fee model with access to tax‑advantaged accounts

- Encourages both business growth and long‑term wealth building

- Not a conventional checking account or full banking service, may lack some banking features

- Best suited for those who also prioritize investing, not purely businesses looking for a standard business bank account

- If you need heavy banking (cash deposits, large ACH flows), might need a dedicated business account in addition

How to Choose the Best Bank for Your LLC

Ask yourself these questions before deciding:

- Does the bank support LLCs directly, not just sole proprietors?

- Do you need integrations with tools like QuickBooks or Shopify?

- How often do you deposit cash or checks?

- Do you need multiple accounts under one LLC?

- Do you want interest, rewards, or both?

If you want simplicity, go with Grasshopper Bank or Relay. For higher APY and automation, NorthOne stands out. For a tech-forward experience, Rho is ideal. And if you want both banking and investing tools, FutureMoney is worth exploring.

Final Thoughts

The best online banks for LLCs in 2025 are the ones that give you control, transparency, and savings without the hassle of monthly fees. Every option on this list offers real value depending on how you run your business. If you’re scaling fast and want automation, try Rho or NorthOne. For organized, cash-flow management, choose Relay. If you want professional credibility with digital convenience, Piermont Bank fits perfectly. Setting up the right bank account now can make bookkeeping easier, taxes smoother, and financial decisions more confident.