Access to fast funding is essential for small businesses looking to expand, cover expenses, or manage cash flow. But if you’ve ever applied for a traditional bank loan, you know the process can be slow, require tons of paperwork, and demand perfect credit. That’s where alternative lenders like Fora Financial come in.

Fora Financial offers fast, unsecured funding for small businesses, with flexible requirements and approval within hours. But is it the right funding option for your business? In this review, we’ll break down how Fora Financial works, its pros and cons, and how it compares to competitors.

What is Fora Financial?

Fora Financial is an alternative business lender that provides small business loans and revenue advances to companies across various industries. Unlike traditional banks, it doesn’t require collateral, long application processes, or high credit scores. The company specializes in fast, short-term funding—ideal for businesses that need cash quickly but may not qualify for traditional financing.

Key Features

Fast business funding with flexible repayment options

No strict credit score requirements

Loans and cash advances up to $1.5 million

Why We Recommend It

Fora Financial helps small businesses get quick funding without the hassle of traditional banks. It’s a great option for businesses that need fast cash to grow, cover expenses, or manage cash flow

Pros & Cons

- Quick approval and funding process

- No collateral required

- Flexible repayment terms

- Higher interest rates than traditional loans

- Not ideal for startups with no revenue history

Key Features of Fora Financial

- Small Business Loans: Borrow $5,000 to $1.5 million with repayment terms up to 18 months.

- Revenue Advances: Similar to merchant cash advances, repayments adjust based on sales volume.

- Fast Approval Process: Get approved in as little as 4 hours, with funding within 72 hours.

- Lenient Credit Requirements: Minimum FICO score of 570—much lower than traditional banks.

- No Collateral Required: Loans are unsecured, so you don’t have to put up assets like real estate or inventory.

Fora Financial is best for businesses that need funding fast and don’t have the credit history to qualify for traditional bank loans.

Pros and Cons of Fora Financial

Like any funding solution, Fora Financial has benefits and drawbacks.

Pros

- Fast Funding – Apply, get approved, and receive funds within 72 hours.

- Lower Credit Requirements – Minimum 570 FICO score, so even businesses with less-than-perfect credit can qualify.

- Flexible Repayments – Revenue advances adjust based on sales, which is great for businesses with seasonal fluctuations.

- No Collateral Needed – Unlike traditional bank loans, Fora Financial’s funding is unsecured.

- Versatile Use Cases – Funds can be used for inventory, payroll, marketing, renovations, and more.

Cons

- High Costs – Interest rates, factor rates, and origination fees can be expensive.

- Short Repayment Terms – Loans must be repaid within 18 months.

- Frequent Payments – Requires daily or weekly repayments, which may strain cash flow.

- Limited Loan Products – Only offers small business loans and revenue advances—no traditional lines of credit or term loans.

Fora Financial is not the best option for businesses needing long-term financing or lower interest rates, but it works well for those needing quick, short-term funding. Watch our full review below

Fora Financial Review: BEST Way To Get Funding For Your Business in 2025?

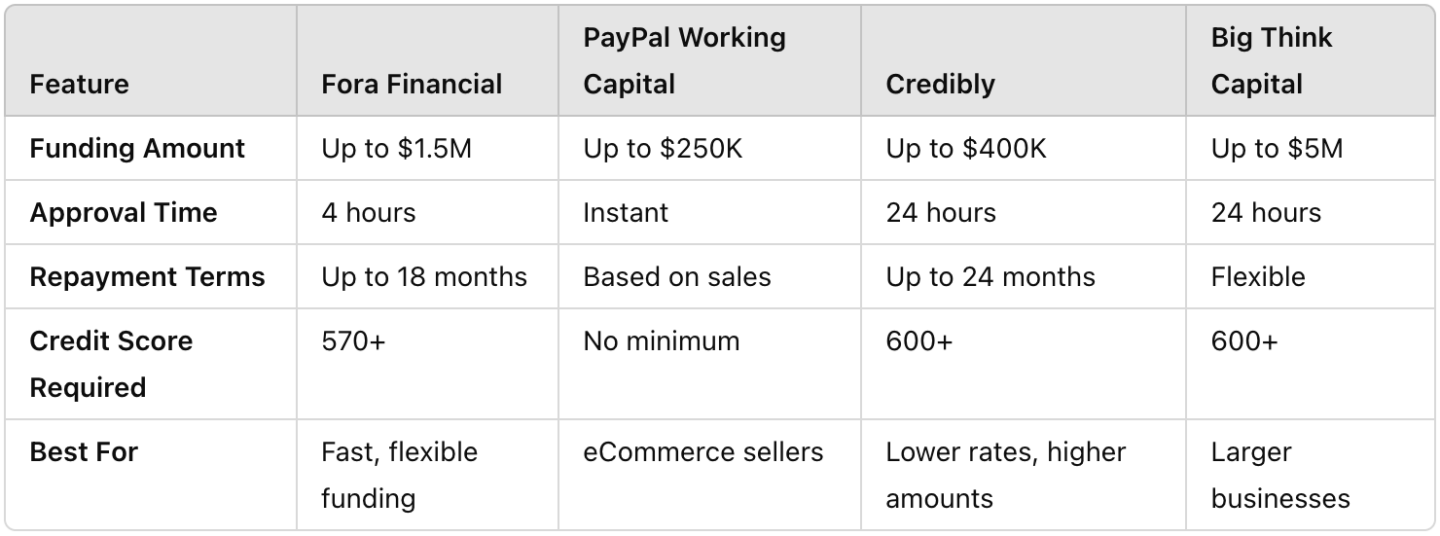

How Does Fora Financial Compare to Other Business Lenders?

Fora Financial isn’t the only alternative lender out there. Here’s how it stacks up against some competitors:

- PayPal Working Capital: Great for eCommerce businesses with PayPal sales history. Lower loan amounts but faster funding.

- Credibly: Offers higher loan amounts and better rates but requires stricter credit requirements.

- Big Think Capital: Best for larger businesses needing high loan amounts and flexible repayment terms.

Fora Financial is a strong choice for businesses that need quick cash but don’t qualify for bank loans.

Who Should Use Fora Financial?

Fora Financial is best for:

- Businesses with inconsistent revenue – Flexible repayments make it easier for seasonal businesses to manage cash flow.

- Companies that need fast funding – Approval takes 4 hours, and funds are available within 72 hours.

- Business owners with low credit scores – Fora Financial has lower credit requirements than traditional lenders.

- Small businesses needing short-term capital – If you only need funds for a few months to a year, Fora Financial is a great option.

Who shouldn’t use Fora Financial?

- Businesses looking for long-term loans—since repayment terms max out at 18 months.

- Companies with strong credit that can qualify for lower-cost bank loans.

- Entrepreneurs who can’t handle daily or weekly repayments.

How to Apply for Fora Financial

Applying for Fora Financial is simple. Here’s how it works:

- Submit an application – Provide basic business details and three months of bank statements.

- Get approved within 4 hours – Fora Financial will review your cash flow and revenue instead of relying solely on credit scores.

- Receive funding within 72 hours – Once approved, you’ll get your funds quickly.

- Repay through daily or weekly payments – Payments are automatically deducted based on your agreed-upon terms.

Since the approval process focuses on business revenue instead of just credit scores, many small businesses that get denied by banks can still qualify for Fora Financial funding.

Is Fora Financial Right for You?

- If you need funding fast and have a lower credit score, it’s a great option.

- If you want longer repayment terms and lower costs, consider traditional bank loans or SBA loans.

Final Thoughts: Is Fora Financial Worth It?

Fora Financial is one of the best options for small businesses that need fast, short-term funding. Its quick approval process, lenient credit requirements, and flexible repayment options make it a solid choice for business owners who don’t qualify for traditional loans.

However, it comes with higher costs, short repayment terms, and daily/weekly payments, which could be challenging for businesses with tight cash flow.