If you’re starting a business in 2025, you’re going to need an Employer Identification Number (EIN)—even if you’re the only person running the show. An EIN is like a social security number for your business. It’s issued by the IRS and is required for paying taxes, opening a business bank account, hiring employees, and building business credit. The good news? Getting an EIN is fast, free, and easy—and in this guide, I’ll walk you through exactly how to do it.

Why Do You Need an EIN?

Even if you’re a solo entrepreneur or freelancer, having an EIN can be a game-changer. Here’s why:

1. Separates Business and Personal Finances

An EIN legally separates your business from your personal identity, which makes things cleaner for taxes, banking, and legal protection.

2. Required for LLCs and Corporations

If you’ve formed an LLC or Corporation, the IRS requires you to have an EIN to file taxes.

3. Helps You Open a Business Bank Account

Most banks won’t let you open a business account without an EIN. Keeping business and personal money separate is essential for bookkeeping and tax deductions.

4. Allows You to Hire Employees

Thinking about expanding your team? An EIN is required to hire employees and set up payroll.

5. Builds Business Credit

An EIN helps you establish business credit, making it easier to get business loans, apply for credit cards, and secure funding. Even if you’re a solo entrepreneur, getting an EIN is one of the first steps to making your business official.

How to Apply for an EIN (Step-by-Step Guide)

Applying for an EIN is completely free, and you can do it in just a few minutes. Here’s how:

Step 1: Determine Your Eligibility

To apply for an EIN, you must:

- Have a business based in the U.S. or U.S. territories.

- Have a valid Taxpayer Identification Number (SSN, ITIN, or another EIN).

- Be the business owner, founder, or someone with authority to apply.

If you meet these requirements, you’re good to go.

Step 2: Choose Your Application Method

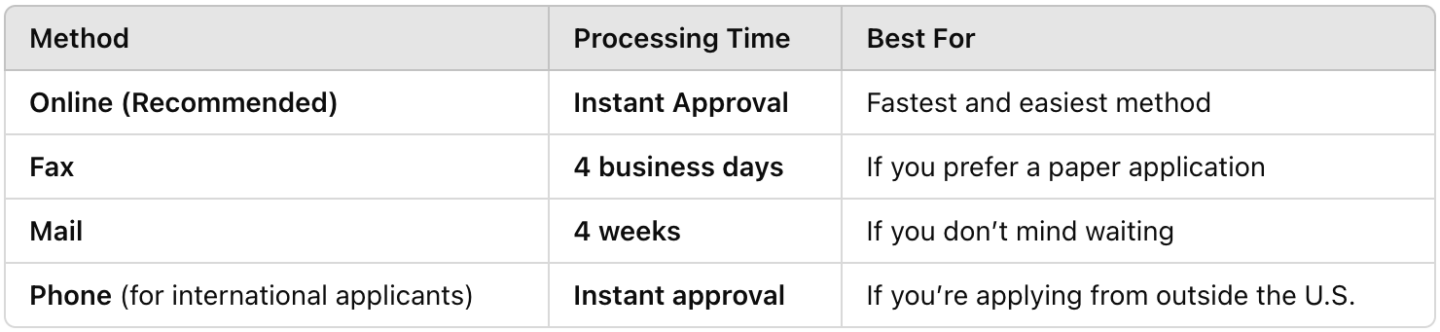

You can apply for an EIN in four ways:

Step 3: Apply for an EIN Online (Fastest Method)

The easiest way to get an EIN is online through the IRS website. Here’s what to do:

- Go to the IRS EIN Assistant: Visit the official IRS EIN application page.

- Select Your Business Entity: Choose Sole Proprietor, LLC, Corporation, or Partnership.

- Enter Your Business Information: Fill in your name, business name, address, and type of business.

- Confirm Business Purpose: Indicate if your business will have employees (even if the answer is “no,” you can still apply).

- Receive Your EIN Instantly: After completing the form, you’ll get your EIN immediately as a PDF.

Tip: Print or save your EIN confirmation letter—the IRS won’t send another copy if you lose it.

Step 4: Use Your EIN for Business Activities

Once you have your EIN, start using it right away for:

- Opening a business bank account.

- Filing business taxes (for LLCs, Corporations, and Sole Proprietors who hire employees).

- Applying for business credit cards and loans.

- Setting up payroll for employees.

- Registering for state and local business licenses.

Final Thoughts: Is Getting an EIN Worth It?

If you’re serious about starting and growing your business, getting an EIN is one of the easiest and smartest steps you can take.

✔ It’s free and takes just a few minutes to apply.

✔ It separates business and personal finances, which makes tax time easier.

✔ It helps you open business bank accounts and build business credit.

Even if you’re a solo entrepreneur or freelancer, having an EIN makes your business look more professional and opens up more financial opportunities.

What to Do Next

- Go to the IRS website and apply for your EIN.

- Save your EIN confirmation letter.

- Use your EIN to open a business bank account and build business credit.

By taking this simple step, you’ll be setting your business up for long-term success.