Choosing the proper legal structure for your business is one of the most important decisions you’ll make as an entrepreneur. It impacts your taxes, personal liability, paperwork, and ability to raise funding. With new regulations and changes in the business landscape, understanding the best business entity for your startup in 2025 is more important than ever. This guide will break down the most common legal structures, their benefits, drawbacks, and which one is best for your business.

Why Your Business Legal Structure Matters

Your legal structure affects several key areas:

- Liability Protection – Some structures protect your personal assets, while others don’t.

- Taxes – Different entities have different tax rules and benefits.

- Funding & Investment – Some structures make it easier to attract investors.

- Compliance & Paperwork – Certain structures require more paperwork and regulations.

Choosing the wrong structure can lead to unnecessary taxes, legal risks, or limited growth potential.

The Most Common Business Structures in 2025

1. Sole Proprietorship

Best for: Freelancers, solopreneurs, and small businesses with minimal risk.

A sole proprietorship is the simplest and most affordable way to start a business. It’s an unregistered business owned by one person.

Pros:

- Easy to set up with minimal paperwork.

- No separate business taxes—profits are taxed as personal income.

- Full control over business decisions.

Cons:

- No liability protection—your personal assets are at risk.

- Harder to raise money—banks and investors usually prefer LLCs or corporations.

- It can become a tax burden as income grows.

2. Limited Liability Company (LLC)

Best for: Small businesses, startups, and entrepreneurs who want legal protection without corporate complexity.

An LLC (Limited Liability Company) is a hybrid structure that protects personal assets while keeping taxes flexible. It’s one of the most popular choices for small businesses and startups.

Pros:

- Personal asset protection—your personal savings, home, and car are separate from business liabilities.

- Flexible taxes—you can choose to be taxed as a sole proprietorship, partnership, or corporation.

- Less paperwork than a corporation.

Cons:

- Costs more to set up than a sole proprietorship.

- Requires annual filings and fees in most states.

- Harder to raise investor funding compared to a corporation.

It’s better for entrepreneurs looking for liability protection without the corporate hassle. Ideal for small businesses, e-commerce brands, and service providers.

3. S Corporation (S-Corp)

Best for: Profitable small businesses and startups wanting tax advantages.

An S Corporation is a special type of corporation that avoids double taxation by passing profits to owners’ personal tax returns.

Pros:

- No corporate income tax—profits pass through to owners.

- Tax savings—owners can pay themselves a reasonable salary and take the rest as dividends (which are taxed lower).

- Limited liability for business debts.

Cons:

- Strict regulations—limited to 100 shareholders, and all must be U.S. citizens.

- Requires more paperwork than an LLC.

- It is not ideal for attracting large investors.

Profitable businesses want lower taxes and personal asset protection.

4. C Corporation (C-Corp)

Best for: Startups planning to scale and raise money from investors.

A C Corporation is the default type of corporation and is best for startups looking to raise venture capital or go public.

Pros:

- Unlimited growth potential—can issue shares to investors.

- Liability protection—owners are not personally responsible for business debts.

- Lower tax rates on retained earnings if profits stay in the business.

Cons:

- Double taxation—profits are taxed at the corporate level, then again as personal income when distributed.

- Requires extensive paperwork and compliance.

- More expensive to set up and maintain than an LLC.

Startups are planning to raise investment capital or go public in the future.

5. Partnership (General or Limited)

Best for: Businesses with two or more owners who want a simple structure.

A partnership is a business owned by two or more people. There are two types:

- General Partnership (GP) – All partners share equal responsibility.

- Limited Partnership (LP) – One partner manages the business while others act as investors.

Pros:

- Simple to start with minimal paperwork.

- Pass-through taxation (profits go directly to owners’ tax returns).

- Shared decision-making and financial investment.

Cons:

- General partners have unlimited liability—they are personally responsible for debts.

- Harder to raise funding compared to corporations.

- Disagreements between partners can cause business issues.

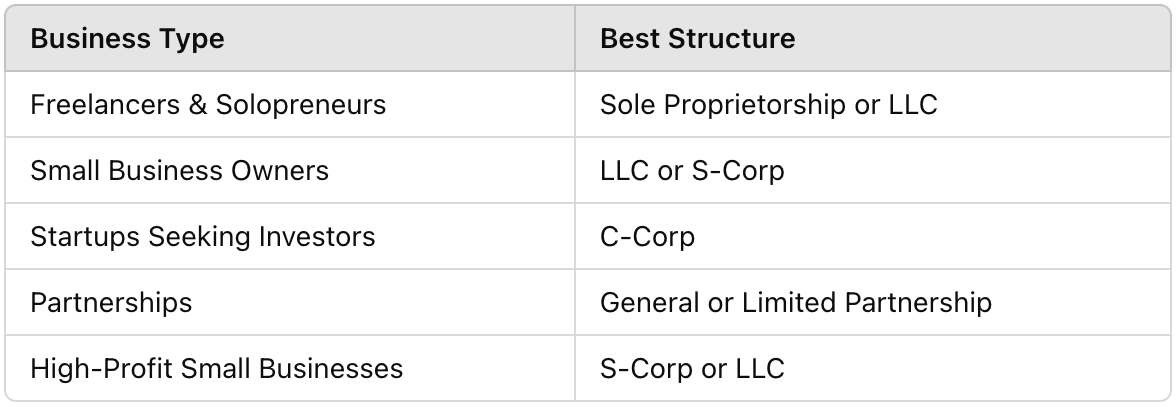

Which Business Structure is Best for You?

The best legal structure depends on your business goals, risk tolerance, and financial plans.

If you’re just starting out, an LLC is the best choice for most entrepreneurs due to its balance of liability protection, flexibility, and tax benefits. If you plan to raise investor capital, a C-Corp is the best structure since it allows for stock issuance.

How to Register Your Business in 2025

Once you’ve chosen your structure, here’s how to legally register your business:

- Choose a Business Name – Check availability with your state and secure a domain name.

- Register with the State – File the necessary paperwork (LLC formation, corporation articles, or partnership agreements).

- Get an EIN (Employer Identification Number) – Apply for free on the IRS website.

- Open a Business Bank Account – Keep personal and business finances separate.

- Apply for Necessary Licenses and Permits – Check federal, state, and local requirements.

If you’re looking for a state-specific guide, check out our full breakdown below.

Final Thoughts

Choosing the right business structure is one of the most important decisions when starting a business. It impacts taxes, liability, and your ability to raise money.

For most small business owners and entrepreneurs, an LLC is the best option since it provides liability protection without the hassle of a corporation. If you’re planning to scale and attract investors, a C-Corp is the way to go.

Next Steps:

- Decide on the best structure for your business.

- Register your business with your state.

- Get your EIN and open a business bank account.

- Make sure you have all necessary licenses and tax registrations.

By choosing the right legal structure, you set your business up for long-term success and financial security.