If you’re a freelance designer and thinking about turning your creative work into a real business, you’ve probably asked yourself one big question: Do I need to form an LLC, or can I just be a sole proprietor?

This decision affects your taxes, legal protection, and how professional you look to clients. And while it might sound like a legal mess, it doesn’t have to be. In this guide, we’ll break down the differences between an LLC and a sole proprietorship in plain English, walk through the pros and cons of each, and help you decide what’s right for you in 2025. Let’s get into it.

What’s the Difference Between LLC vs Sole Proprietor?

Sole Proprietor:

This is the default. If you start offering design services and make money, you’re automatically a sole proprietor, even if you don’t register anything.

LLC (Limited Liability Company):

This is a formal business structure that you set up through your state. It creates a separate legal identity for your business, which matters when it comes to liability, taxes, and looking legit.

Why This Matters for Designers

As a designer, you’re likely:

- Working with multiple clients

- Sending contracts and invoices

- Handling revisions, files, and payments

- Possibly hiring help or subcontractors later

So while your work is creative, your structure needs to protect your time, money, and reputation. Let’s compare the two.

The Pros of Staying a Sole Proprietor

If you’re just getting started or only working with a few small clients, being a sole proprietor can work for a while. Here’s why:

- It’s free. No formation fees or annual filings (except for a local business license if required).

- No paperwork. You can start today without any legal forms.

- Easy taxes. You report everything on your personal tax return using Schedule C.

But here’s the problem: You and your business are the same. That means if a client sues you or you run into debt, your personal assets (car, savings, etc.) are on the line.

Why Most Designers Eventually Switch to an LLC

Here’s what you get when you form an LLC:

- Legal protection. Your business is legally separate from you. If someone sues your LLC, they can’t go after your personal stuff.

- Credibility. Clients take you more seriously when you have “LLC” in your business name.

- Business bank accounts and credit. It’s easier to open financial tools and build business credit.

- Tax flexibility. You can stay a “disregarded entity” (just like a sole prop) or choose to be taxed as an S Corp later on.

It does cost money, usually $50 to $300, depending on your state, and requires an annual report in most places. But for many designers, the benefits outweigh the hassle.

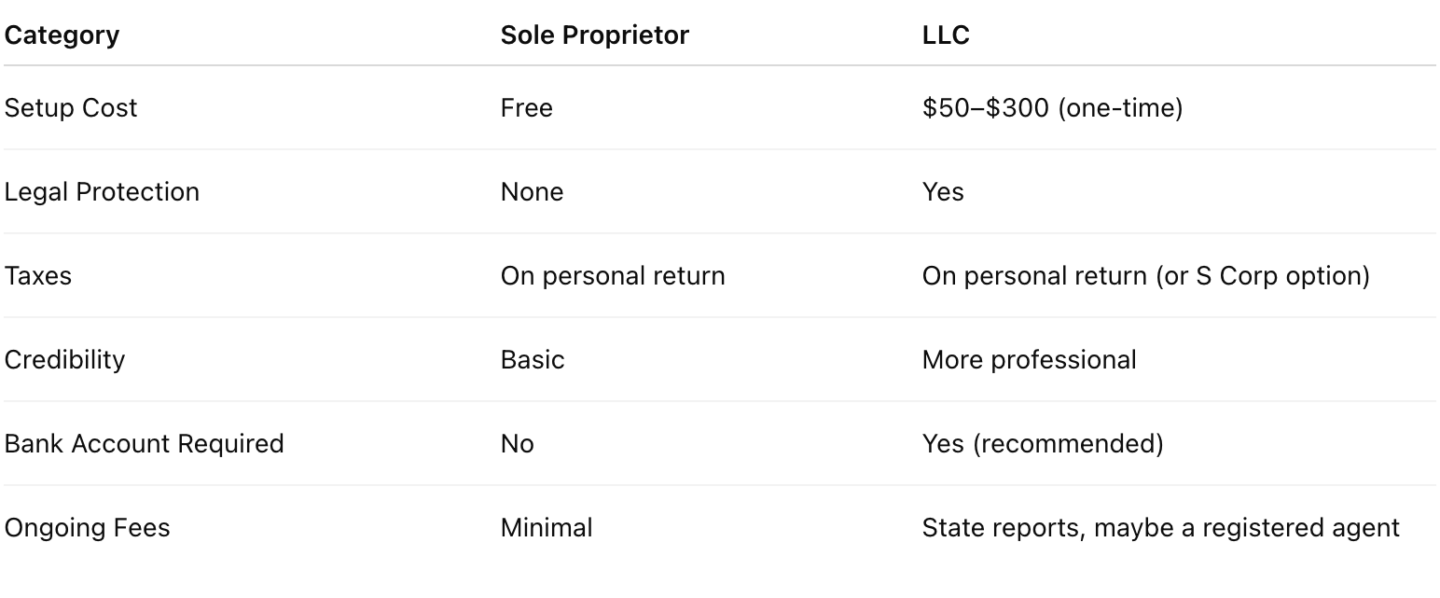

Quick Comparison: LLC vs Sole Proprietor

Use a Registered Agent to Save Time

If you’re going the LLC route, consider using a registered agent service like Northwest Registered Agent, Bizee, or Tailor Brands.

- Special $39 pricing to form your company

- Well-established and trusted service

- Includes free registered agent service for 1 year ($125 value)

- Privacy is guaranteed so your info stays off public records

- Fast filing and processing times

BEST OVERALL FOR BUSINESS FORMATION

- Form your LLC for $0 + get an extra 35% off

- Includes branding and tax assistance

- Access to a 24/7 priority support team

- Fast and efficient LLC filing services

- Expert guidance throughout your business journey

BEST FOR QUICK AND AFFORDABLE BUSINESS FORMATION

- Pricing starts at $0 + state fees (although we recommend 99% of users choose the Gold or Premium plans)

- Free registered agent service for 1 year

- Easy-to-use dashboard

- No hidden fees and no contracts

- 24/7 fast and friendly customer service

BEST FOR EFFORTLESS BUSINESS FORMATION

They’ll help you stay compliant, handle official documents, and make sure you don’t miss legal notices. It’s worth it if you want to stay focused on design, not paperwork.

When to Start as a Sole Prop and Upgrade Later

If you’re testing your first few projects, don’t overthink it. You can:

- Launch as a sole proprietor

- Track income and expenses

- See if you want to pursue it long-term

- Form an LLC once you hit consistent income or land bigger clients

The key is knowing when to level up your structure.

What About Taxes?

Here’s the good news: Both structures can start out simple.

- Sole Prop: File a Schedule C with your 1040.

- LLC: If it’s just you, you’re still taxed as a sole proprietor by default.

- LLC (S Corp): Once you’re making around $50K+ per year, you can elect S Corp status to pay yourself a salary and save on self-employment taxes.

If you’re not sure when to do this, talk to a tax pro. But don’t let taxes hold you back from forming your business. You can grow into the complexity.

The Real Question: What’s Your Vision?

If you’re building a serious brand, planning to raise your rates, or want to land agency-level clients, having an LLC is the move. It shows you’re organized, responsible, and running a real business, not just freelancing on the side. If you’re just exploring or doing passion projects, sole proprietorship gives you a clean and free way to start.

Final Thoughts

The best structure depends on your goals, but one thing is true across the board: You need to treat your business like a business. Start tracking your income. Open a separate bank account. Set up your system now, so when bigger clients or funding opportunities come along, you’re ready.

If you’re ready to form your LLC, check out Bizee, Northwest, or Tailor Brands, they’ll walk you through it in minutes and handle the hard stuff for you. Design your future, not just your next logo. Start with a structure that supports you now and scales with you later.