When you start a small business with others, picking the right way to set up your business is key. Each type has its own rules and effects on your business, so it’s essential to understand them well to make the best choice. This blog will explain general and limited partnerships, how they work, and what to consider before setting one up.

What is a General Partnership?

A general partnership is the most accessible type of partnership. In this setup, two or more people come together to start a business and agree to share the profits, losses, and decision-making. Each partner has an equal say in how the company is run unless you agree otherwise, and each partner is also fully responsible for the business’s debts and legal issues.

Features of a General Partnership:

- Equal Responsibility: All partners manage the business and make decisions.

- Personal Liability: Each partner can be held personally responsible for any debts and legal problems the business faces.

- Easy to Start: General partnerships are simple, usually needing little more than local business licenses and registrations.

Benefits:

- Simple to Manage: These partnerships are straightforward, with minimal paperwork and low startup costs.

- Flexible: Partners can share resources and help manage the business, allowing for a flexible work relationship.

Drawbacks:

- Risk to Personal Assets: If the business fails or gets sued, each partner’s assets, like home and savings, are at risk.

- Potential for Disagreements: Without a written agreement, partners might disagree on decisions, profit sharing, and responsibilities, which can cause problems.

What is a Limited Partnership?

A limited partnership is more complex than a general partnership and includes both general and limited partners. This setup allows for limited partners who invest money but don’t make day-to-day business decisions, which one or more general partners handle.

Features of a Limited Partnership:

- Mixed Liability: General partners manage the business and have unlimited liability, while limited partners have limited liability, meaning they are only liable for the amount they invest.

- Attracts Investors: LPs can attract investors who want to benefit from the profits but don’t want to manage the business.

- Formal Setup: Starting an LP requires filing official paperwork with the state, including a detailed partnership agreement.

Benefits:

- Protection for Limited Partners: Limited partners risk only the money they’ve put into the business.

- Defined Roles: Clear roles prevent management conflicts; general partners run the business day-to-day.

- More accessible to Raise Money: LPs can easily attract new investors as limited partners without changing who manages the business.

Drawbacks:

- More Complex to Start: Setting up an LP can be more complicated and expensive due to extra-legal and filing requirements.

- Less Flexible: Making changes, like a general partner leaving, might require updates to the formal partnership agreement.

What is a Limited Liability Partnership (LLP)?

An LLP is a type of partnership where all partners have some protection from being personally liable for business debts or mistakes made by other partners. Professionals like lawyers, accountants, and architects who work together in a business often choose this setup. In an LLP, while each partner manages parts of the company, they won’t be held responsible for others’ errors or negligence. Your personal assets (like your house or car) are usually protected if something goes wrong because of another partner.

Features of a Limited Liability Partnership:

- Liability Protection: Each partner is protected from personal liability for specific actions of other partners.

- Flexible Management: All partners can participate in management without affecting their liability protection.

- Professional Use: Commonly used by professionals such as lawyers, doctors, and accountants.

Benefits:

- Personal Asset Protection: Protects each partner’s assets from the partnership’s liabilities.

- Tax Advantages: Benefits from pass-through taxation, avoiding the double taxation standard in corporations.

- Professional Independence: Allows professionals to work together while retaining individual liability protection.

Drawbacks:

- Complex Regulations: These are subject to varying state laws that complicate compliance.

- Limited Scope: Only available to certain types of professional services.

- Higher Operating Costs: Often more expensive to form and operate due to legal and accounting services.

What is a Limited Liability Limited Partnership (LLLP)?

An LLLP is a particular type of partnership that mixes features from both LLPs and traditional alliances. In this structure, general partners run the business and, similar to limited partners, enjoy protection from being personally liable for business issues. This means that all partners, no matter their role, have some protection for their personal assets against business debts or legal problems.

Features of a Limited Liability Limited Partnership:

- Enhanced Liability Protection: Provides all partners, including those involved in management, with protection from personal liability.

- Combines LLP and LP: Offers the benefits of both LLP and LP structures.

- State-Specific Availability: Not recognized in all states, so that availability can be limited.

Benefits:

- Comprehensive Liability Shield: Extends liability protection to all partners, reducing personal risk.

- Flexibility in Management: Allows general partners to participate in management without losing liability protection.

- Attractive to Passive Investors: Secure for investors who prefer not to be involved in daily operations.

Drawbacks:

- Limited Recognition: Unable or recognized in every state limits operational flexibility.

- Complexity in Setup and Maintenance: Requires more formalities in setup and ongoing compliance.

- Potential for Legal Complexity: It can be complex to manage legally, often requiring expert legal advice.

What is a Joint Venture?

A joint venture is when two or more people or companies agree to work together on a specific project or business activity, sharing the costs and profits. Each partner in a joint venture is responsible for their share of the business, but the venture is treated as a separate project from their other business interests. Joint ventures are typically formed for one particular project or for a limited time and can be organized in various ways, depending on the project’s needs.

Features of a Joint Venture:

- Project-Specific Partnership: Formed for a specific project or limited time period.

- Shared Resources and Expertise: Partners contribute their expertise and resources for the project’s success.

- Separate Entity: Often set up separately from the partners’ other business interests.

Benefits:

- Shared Risk and Reward: Partners share the venture’s risks and rewards.

- Increased Resources: Bring together diverse resources and expertise, enhancing the venture’s potential.

- Strategic Flexibility: Can be structured to suit the project’s or collaboration’s specific needs.

Drawbacks:

- Complexity in Formation: Negotiating and setting up can be complex, especially with multiple partners.

- Limited Duration and Scope: Typically limited to the project’s duration, which can limit long-term business growth.

- Potential for Conflict: Differences in management style and business culture can lead to conflicts.

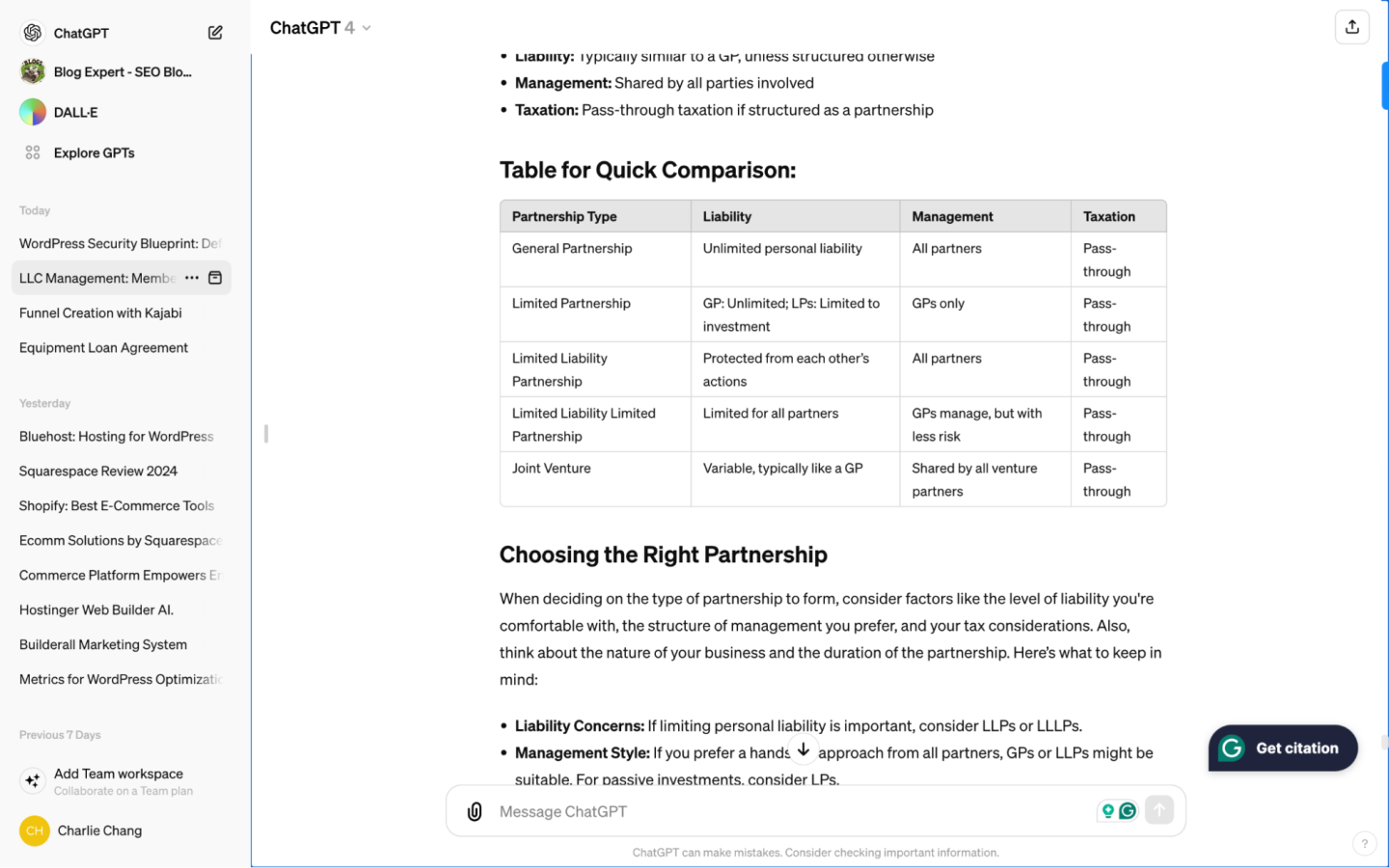

Comparison Overview:

Things to Think About Before Starting a Partnership

Choosing the Right Setup:

- Consider How Much You Want to Be Involved: All partners fully participate in a GP. You can have investors who don’t manage the business in an LP.

- Think About Liability: A GP might not suit you if you’re worried about risking your assets. In an LP, only general partners face entire liability.

Creating a Partnership Agreement:

- Define Everyone’s Role: Clearly state who does what, how decisions are made, and how you’ll handle disagreements.

- Talk About Money: Be clear about how much each partner will invest and how you’ll split profits and handle losses.

- Plan for Changes: Decide how to add new partners or handle it if someone wants to leave.

Legal and Tax Stuff:

- Know Your Taxes: Partnerships themselves don’t pay taxes. Instead, profits and losses are reported on the partners’ tax returns.

- Follow the Rules: Ensure that your partnership complies with all local, state, and federal laws and obtains any permits or licenses you might need.

Conclusion

Choosing between a general partnership and any limited partnerships depends on what you want out of your business, how much risk you’re willing to take, and how you plan to run your company. Knowing each type’s differences and legal needs can help you choose the best structure for your business. No matter which type you pick, having a clear and legal partnership agreement is crucial for smooth operations and success.