Starting a business is exciting, but choosing the right legal structure is one of the most important decisions you’ll make. The right choice impacts your taxes, liability, fundraising ability, and even daily operations.

In 2025, with more entrepreneurs launching online businesses, remote-first startups, and side hustles, it’s even more crucial to pick a structure that aligns with your goals.

This guide breaks down the most common legal structures—Sole Proprietorship, LLC, S-Corp, and C-Corp—and their pros and cons so you can make the best decision for your startup.

1. Sole Proprietorship – Best for Solo Entrepreneurs & Freelancers

A Sole Proprietorship is the simplest and most affordable business structure. If you’re a freelancer, consultant, or solopreneur, this is the easiest way to start.

Pros:

- Easy & cheap to set up – No complex paperwork, just start selling.

- Full control – You make all business decisions without partners.

- Simple taxes – Report income on your personal tax return (no corporate taxes).

Cons:

- Unlimited personal liability – If your business gets sued, your personal assets are at risk.

- Harder to raise funding – No stock or equity options for investors.

- Higher self-employment taxes – You pay both employer and employee Social Security & Medicare taxes.

Best for: Freelancers, independent contractors, and one-person businesses that don’t have major liability risks.

2. Limited Liability Company (LLC) – Best for Small Businesses & Side Hustles

A Limited Liability Company (LLC) is one of the most popular business structures because it offers liability protection without the complexity of a corporation.

Pros:

- Personal asset protection – Your personal assets (house, car, savings) are shielded from lawsuits.

- Tax flexibility – You can be taxed as a Sole Proprietor, Partnership, or even an S-Corp to reduce self-employment taxes.

- Less paperwork – Fewer compliance requirements than a corporation.

Cons:

- Annual state fees – Some states charge high LLC fees (California’s LLC fee starts at $800/year).

- Limited fundraising ability – LLCs can’t issue stock, making it harder to attract big investors.

Best for: Small business owners, consultants, and online entrepreneurs who want liability protection but don’t need outside investors.

If you decide to form an LLC for your business, check out our handy state-by-state LLC Guides on everything you need to know before setting up your LLC.

3. S-Corporation (S-Corp) – Best for Reducing Self-Employment Taxes

An S-Corp is a special tax election available to LLCs or Corporations that helps business owners reduce self-employment taxes.

Pros:

- Lower taxes – Owners pay themselves a “reasonable salary” and take additional profits as distributions, which aren’t subject to self-employment tax.

- Liability protection – Owners aren’t personally responsible for business debts.

- More credibility – Banks and investors may take an S-Corp more seriously than an LLC.

Cons:

- Strict rules – Limited to 100 U.S. shareholders, and all must be individuals (no corporations or partnerships).

- More paperwork – Requires payroll setup, tax filings, and meeting compliance requirements.

- Salary requirements – The IRS requires owners to take a “reasonable salary,” which adds payroll costs.

Best for: Small business owners who want to reduce taxes but don’t need venture capital funding.

4. C-Corporation (C-Corp) – Best for Startups Seeking Investment

A C-Corporation is a fully separate legal entity from its owners, making it the best choice for startups looking to raise venture capital.

Pros:

- Unlimited fundraising potential – Can issue stock and attract investors.

- Strong liability protection – Personal assets are completely separate from the business.

- Lower corporate tax rate – The federal corporate tax rate is 21%, which can be lower than personal income tax rates for high earners.

Cons:

- Double taxation – Profits are taxed at the corporate level, then again when distributed as dividends to shareholders.

- Expensive to maintain – More compliance, reporting, and legal costs than other structures.

- More paperwork – Requires annual reports, board meetings, and corporate tax returns.

Best for: High-growth startups, tech companies, and businesses planning to raise venture capital or go public.

5. Nonprofit Corporation – Best for Mission-Driven Businesses

If your startup is focused on social good, you can register as a 501(c)(3) nonprofit to access tax exemptions and grant funding.

Pros:

- Tax-exempt status – Nonprofits don’t pay federal income tax.

- Eligible for grants – Can receive government and foundation grants.

- Limited liability protection – Protects directors and officers from personal liability.

Cons:

- Strict compliance requirements – Must follow IRS regulations and file annual reports.

- No personal profits – All revenue must go back into the mission.

- Limited fundraising options – Can’t raise money like a for-profit business.

Best for: Charities, social enterprises, and mission-driven startups looking to operate as a nonprofit organization.

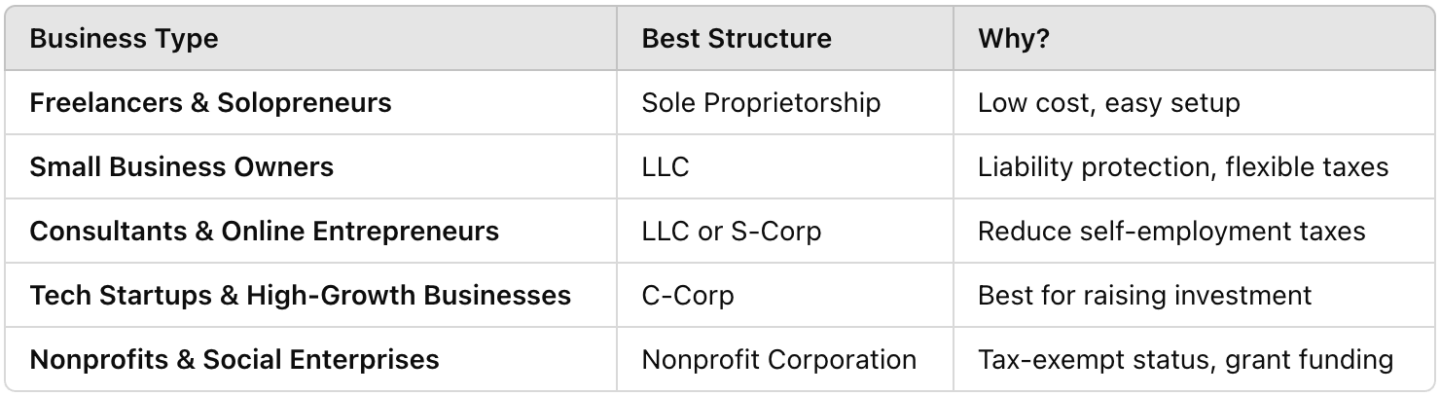

Which Legal Structure is Right for Your Startup?

Here’s a quick comparison to help you decide:

Final Thoughts: Choosing the Best Structure for Your Startup in 2025

There’s no one-size-fits-all answer when it comes to choosing a legal structure. The right choice depends on your business goals, growth plans, and tax preferences.

Key Takeaways:

- If you’re just starting out as a freelancer or solo entrepreneur, a Sole Proprietorship or LLC is the easiest option.

- If you want liability protection, an LLC is the best balance between simplicity and security.

- If you plan to reduce taxes, an S-Corp can help you lower self-employment taxes.

- If you want to raise funding, a C-Corp is required for venture capital and stock options.

- If you’re running a charity or mission-driven organization, consider a Nonprofit Corporation.

Before you decide, consult with a business attorney or tax professional to make sure you’re choosing the structure that best fits your needs.