Paying people from other countries can be complicated because of all the rules and paperwork. Luckily, Deel makes it much more straightforward and effortless. In this article, we’ll discuss Deel, its pros and cons, and how to use it step-by-step to pay your international contractors.

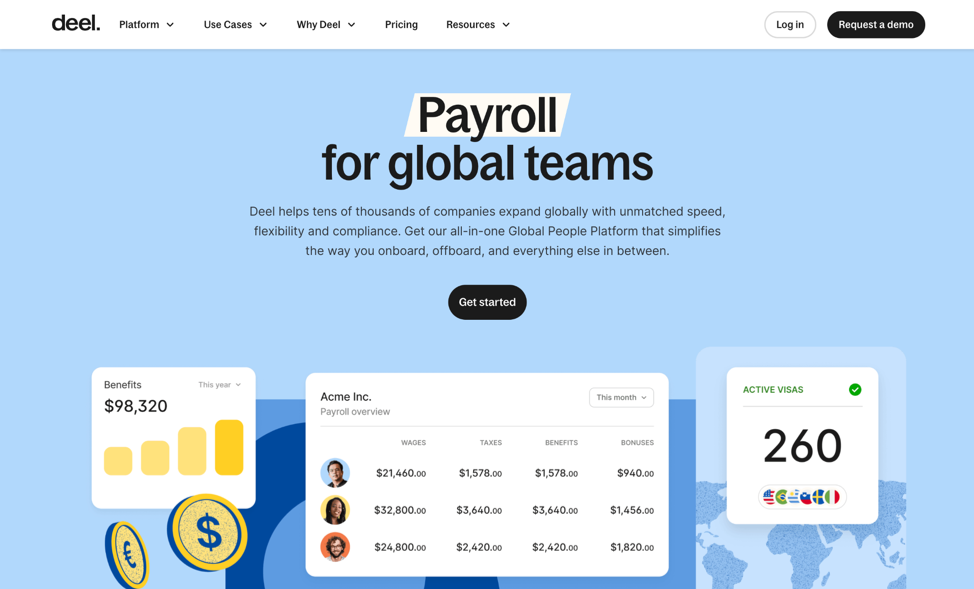

What is Deel?

Deel is a website that simplifies paying and managing your team of contractors worldwide. It provides customizable contract templates that comply with local laws, handles tax compliance, and offers streamlined payment options in local currencies. Deel is an excellent tool for remote team management, allowing you to focus on growing your business.

Deel Pros and Cons

Pros:

- Easy to Use: Deel’s straightforward dashboard allows you to manage contracts and payments with just a few clicks.

- Compliance: It keeps you in line with international laws, protecting you and your contractors.

- Flexible Payment Options: Whether your contractors prefer to be paid via bank transfer, PayPal, or other methods, Deel has got you covered.

Cons:

- Cost: While Deel saves you from many headaches, it comes with service fees.

- Overwhelming Options: The myriad of options and features can initially be a bit overwhelming for new users.

How to Pay International Contractors Using Deel

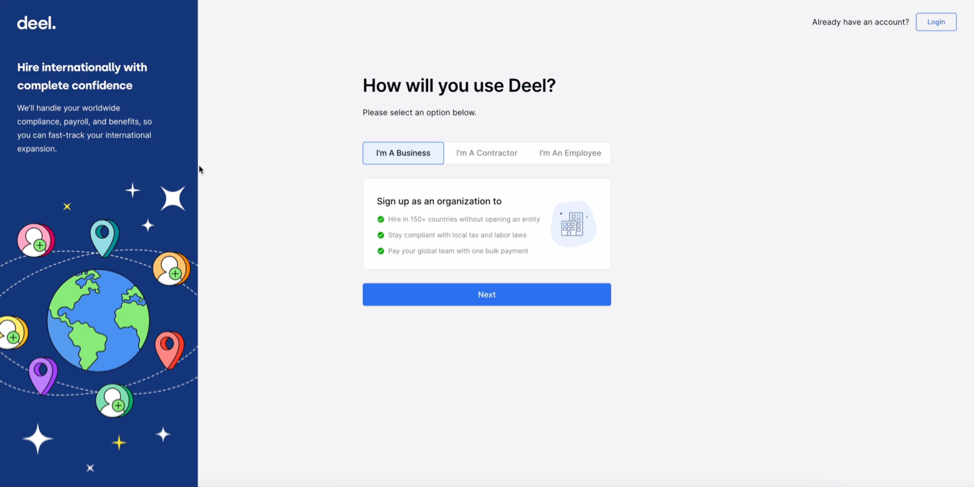

1. Sign Up for Deel and Create an Account

Like signing up for any social media, head over to Deel’s website and create an account. You’ll need to provide some basic information about your business.

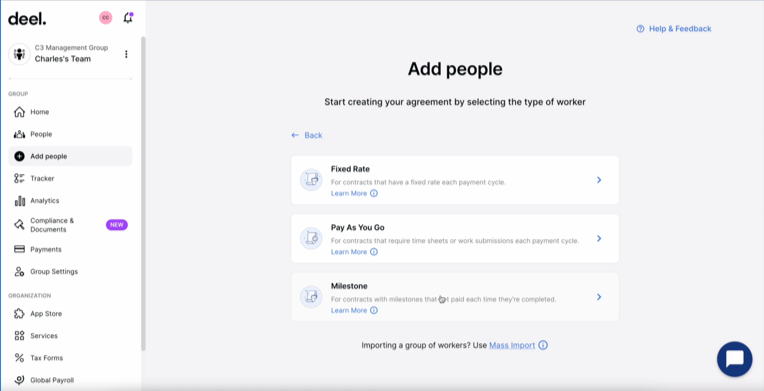

2. Add Your Team Members

Here, you’ll specify whether your team members are employees or contractors.

3. Choose a Payment Method

Deel offers options like fixed-rate, pay-as-you-go, or based on milestones.

4. Enter Worker Details

You’ll need your contractor’s name, email address, and contract details.

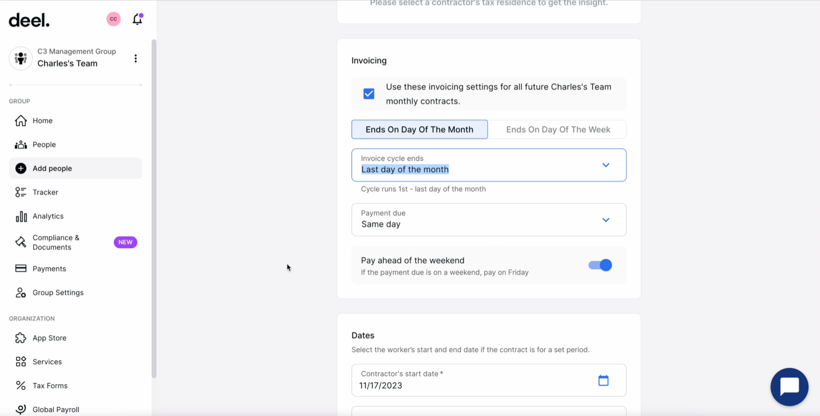

5. Define Your Payment

This includes setting the payment rate, frequency (how often you pay), and invoicing.

6. Set the Contract Start Date and More

You’ll also enter the contractor’s residence details and define the payment terms.

7. Review and Finalize Contract Details

Check over the information, decide on a notice period (if you want one), and choose an end date for the contract (optional). It’s like reviewing your shopping list before you check out.

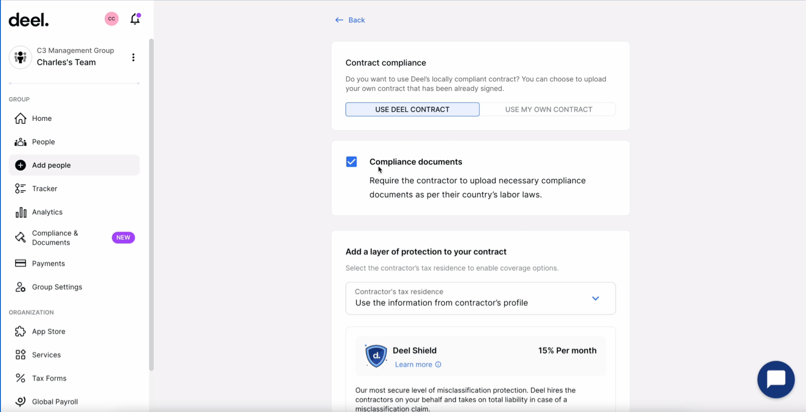

8. Contract Choice

Decide whether to use Deel’s standard contract or upload your own.

9. Upload Compliance Documents

This ensures everything is legal and above board.

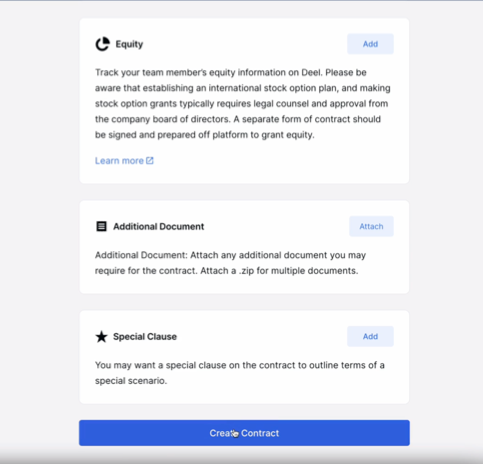

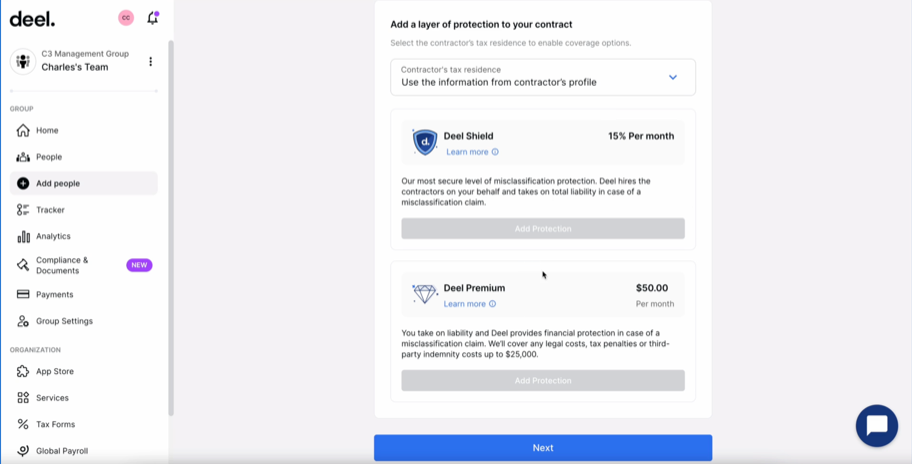

10. (Optional) Add on Additional Service

Deel offers extras like compliance services, insurance, and even equipment rental. It’s like adding unique garnishes to your dish to make it just right.

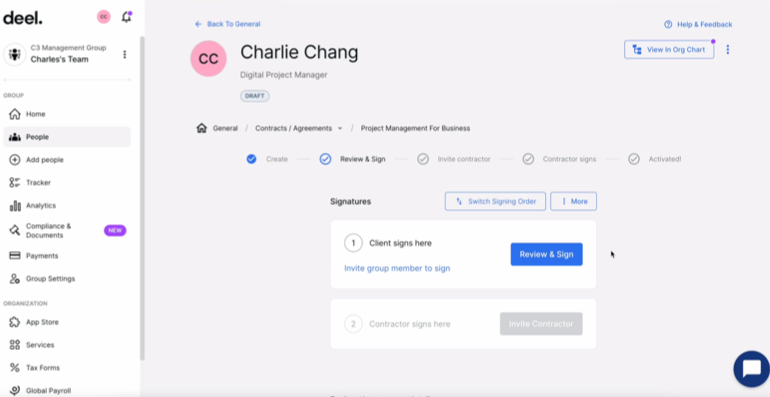

11. Sign the Contract and Invite the Contractor

Once everything looks good, you and the contractor will sign the contract digitally. Imagine it’s like shaking hands on a deal.

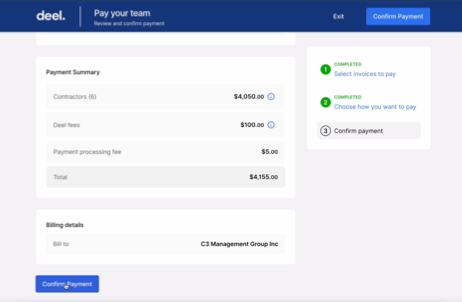

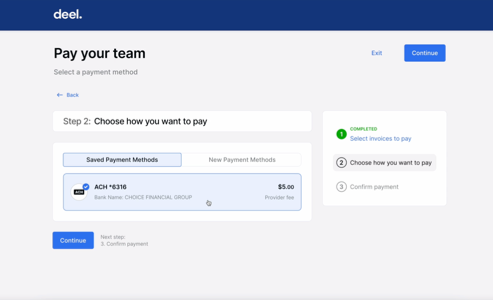

12. Run Payroll

Finally, when it’s time to pay, you’ll go to your dashboard, select the invoices, choose a payment method, and confirm the payments.

Paying international contractors can be a manageable task. With Deel, you can streamline the process, ensuring your global team is paid on time, every time, without legal headaches.

Simplify Your Payments with Deel

Want to try Deel Payment? Now’s the time to make your payment process quicker and smoother. Deel Payment isn’t just a service; it’s your ally in going global. Our easy tools help you pay and get paid in over 150 currencies without the hassle. Plus, you save with low fees and great exchange rates.

Choose Deel for your payments today. It’s your first step to more straightforward, faster global transactions.